You

are receiving this because your address is subscribed at: www.jaunay.com/newsletter.html |

|

|

| No: 132 |

February 2017

|

|

News February Seminars 22: How to be a successful family historian (1st of 7 sessions) 8:00pm WEA Centre, Adelaide See the seminar program for more details and bookings for 2017. What are valuation rolls? Valuation Rolls are an unfamiliar concept for most Australians and as a consequence often overlooked by family historians. Basically these rolls were created for the purpose of determining landowners’ taxation liabilities. As such their value is seemingly restricted to our ancestors who were property owners. Such consideration is flawed and in fact these records have a far greater role in researching family history. At the most basic level the rolls can be used to trace or track people not found in the nineteenth century census returns or for the intervening period between each census. At a more sophisticated level they can be used to determine ownership of an estate that in turn may lead to the estate papers themselves. Remember that estates come in a range of guises and embrace most of the nation. Thus you may find that your ancestors were living in a village within an estate. The estate itself may have been recently owned by a collier and determining the owner of the row houses occupied near a mine might lead in turn to the particular coal company records. |

In

this issue: |

|

Graham Jaunay |

| The term, valuation roll, is usually reserved for Scottish records with other jurisdictions having slightly differing terminology. For example in England they are known as Land Tax Valuations whilst in Ireland simply Valuation Books. In this article the focus is on Scotland but much can equally apply elsewhere. Scotland Valuation Rolls are particularly useful and fall into three groupings—pre-1855, 1855 to 1989 and from 1989. Pre-1855 Rolls were about local and national governments gathering data about landownership, tenancy and houses with a view to raise property taxes. Land tax commenced in 1667 and surviving records are held at the National Records of Scotland in the Exchequer series (E106). These are available online at the ScotlandsPlaces website. Other land tax rolls can be found among Commissioners of Supply records in local archives. They record the value of land for each county down to parish level, together with the names of the proprietors. These records relate to only a tiny proportion of the populace as very few owned land and they rarely list tenants or occupiers. The Lands Valuation Act of 1854 introduced a uniform valuation throughout the country with separate rolls compiled for each county and royal burgh. The National Records of Scotland holds copies of almost all the resulting valuation rolls from 1855 until 1989 (VR121). The rolls were collected annually and record the name and designation of the proprietor, the tenant, the occupier and the annual rateable value. You will note that in the early years of the 1854 scheme, there is little detail about properties rented at under £4pa unless they were on long leases. The information you can find in a valuation roll varies slightly from year to year and between counties and burghs. Early years tend to contain the least information. For example, the 1855 valuation rolls for rural areas do not give a detailed address but merely record the designation and general location as in, House and Farm, Dykesmains. This can also be the case in early rolls for towns and cities. The later valuation rolls include more accurate descriptions of properties and occupations are more frequently included. You can expect to find in most valuation roll records:

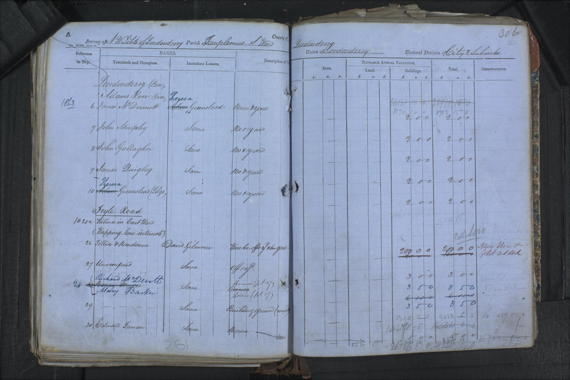

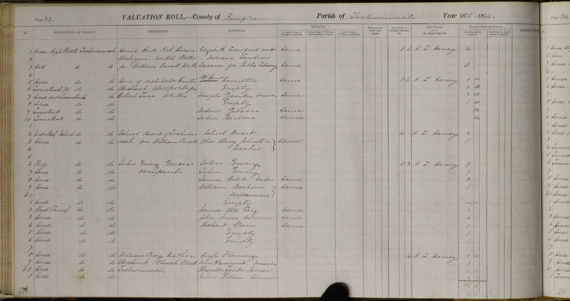

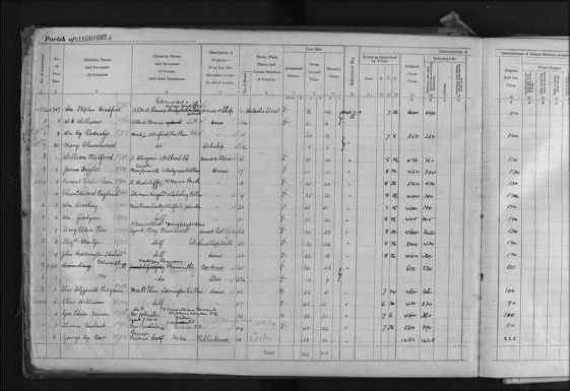

The valuation rolls to 1958 have all been digitised and are available in the search rooms of the National Records of Scotland. A project to index selected valuation roll years is underway. Indexes and images of Valuation Rolls for 1855, 1865, 1875, 1885, 1895, 1905, 1915, 1920, 1925 and 1930 are available at ScotlandsPeople. They can be searched by year; surname; forename; group; status–tenant and occupier, occupier only or all; county/city; parish; burgh, city or place. Unindexed rolls, particularly for the more populous areas can be difficult to search, as there will often be several volumes covering each year. This can often mean a time-consuming search through the volumes in question before you find the entry for the property concerned. Within each volume, the entries are arranged either by parish or by electoral ward in larger towns, and below that level, by street and then by door number or house name. Consequently you may need to find out in which parish and/or electoral ward the property concerned was situated, before being able to identify the correct valuation roll for the relevant year. A Post Office directory or local gazetteer may help to obtain this information. Staff at the National Records of Scotland will not search valuation rolls on behalf of correspondents and short of taking a holiday to Edinburgh one will need to engage a local record agent. It is worth pointing out that there are some duplicate original rolls for specific areas held with local libraries and archives on microfilm. You should check with them as they may have a more helpful research service! With the exception of microfilmed rolls, the valuation rolls for 1958 onwards have to be consulted in volume form and the staff need prior notice because they are held off-site. After 1989, local government taxation in Scotland was based partly on commercial rates and partly by the Community Charge (1989–1993) and Council Tax (from 1993). The National Records of Scotland have copies of all registers of persons liable to pay the domestic community charge or 'Poll Tax' (CCH) between 1989 and 1993 and a full set of copies of council tax valuation lists (CTA). They are not very informative since they only list addresses and give no details of the residents or owners of each property.    Valuation Rolls featuring my family among others pictured above: Top:Londonderry IRL 1863 Roll listing David Gilmour leasing property on Foyle Road. Centre: Lochwinnoch SCT 1875 Roll listing Hugh Fleming renting property in the High Street. Bottom: Devonport ENG 1897 Roll listing William Goodyear owner/occupier in Waterloo Street. |

|

| To

unsubscribe send a blank email via the following link using the same

address you subscribed to: newsletter-leave@jaunay.com |